U.S. Waitlist Rollout (New – December 2025)

As of December 3, 2025:

- The Polymarket iOS app is live on the App Store

- Users can join a waitlist

- Polymarket has begun activating users on that waitlist

- The app has ranked as high as #1 in free sports apps

- Android app: “coming soon”

- Some early users gained access through invitation codes

- The rollout is ongoing and controlled

U.S. Polymarket access is no longer theoretical — it has begun.

Polymarket Review 2025 – Is It Legal for U.S. Traders? Full Guide

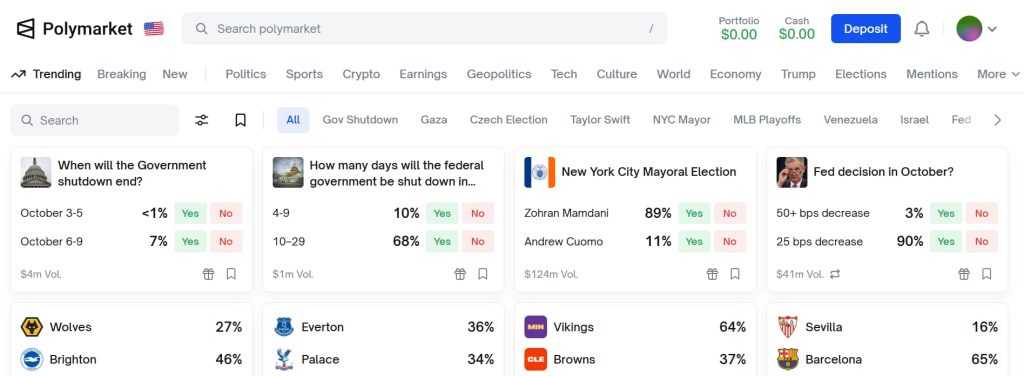

Polymarket is the world’s largest crypto prediction market, where you can trade on real-world events using USDC on the Polygon blockchain. From elections to crypto prices, sports, science, and pop culture, Polymarket lets traders buy and sell YES/NO shares that represent probabilities of outcomes – a concept similar to how prediction markets work.

2025 has marked a turning point for Polymarket in the United States.

After acquiring QCEX (a federally regulated exchange/clearinghouse) and securing CFTC regulatory approvals, Polymarket has now begun rolling out access to U.S. users through a waitlist system, starting with its new iOS app — a milestone that finally puts it alongside Kalshi as a legitimate prediction market option for Americans.

This Polymarket review covers everything you need to know — from how it works and its new U.S. regulatory path to fees, bonuses, and how it compares to rivals like Kalshi. We’ll also look at real user insights to help you decide if Polymarket fits your trading style.

Pressed for Time? Polymarket Essentials.

| Feature | Details |

|---|---|

| Founded | 2020 |

| Founder | Shayne Coplan (CEO) |

| Headquarters | New York City, USA |

| Regulatory Status | Transitioning to U.S. regulation (via QCEX & CFTC relief) |

| Assets | Binary event contracts (YES/NO) |

| Currency | USDC on Polygon |

| Minimum Trade | Under $1 USDC |

| Deposits | Polygon USDC, MoonPay (cards/bank), bridging from Ethereum & other chains |

| Withdrawals | USDC (Polygon) → external wallet |

| Platforms | Web, iOS (live), Android (coming soon) |

| Support | Live chat, Discord, help center |

| Fees | Gas, relayer, on-ramp fees (no “house vig”) |

Jump to (Polymarket Navigation)

What is Polymarket?

Polymarket is a prediction-market platform where you trade YES/NO shares on future events. Each YES share pays $1 if correct and $0 if wrong, and prices represent the market-implied probability. For example:

- A YES share priced at $0.68 implies a 68% chance the market believes the event will occur.

Unlike sportsbooks, Polymarket does not charge a fixed “vig.” Instead, your costs come from:

- Blockchain gas (low on Polygon)

- Liquidity spreads

- On-ramp/bridge fees

- Occasional relayer fees

Is Polymarket Legal in the U.S.?

2022: CFTC settlement

Polymarket paid a civil penalty and geo-blocked U.S. users.

2025: Regulatory comeback

This year, Polymarket:

- Acquired QCEX, a CFTC-regulated exchange & clearinghouse

- Received CFTC approvals, including no-action relief and amended designation for compliant event contracts

- Began relaunching access to U.S. users through a controlled rollout

Current legal status

Polymarket is now operating under a legitimate U.S. regulatory pathway, but with strict conditions:

- KYC/AML required

- Rollout is waitlist-based

- Initial markets limited to sports moneylines

- Some categories (elections, finance, crypto) are self-certified but not yet available in U.S. accounts

- State-level rules may still affect availability

Bottom line:

Polymarket is legal for U.S. users under the new QCEX framework — but availability is phased and market categories are limited for now.

Trading Mechanics – How Polymarket Works

- Binary outcomes: Markets present yes/no questions. Each YES share pays $1 if the event happens; otherwise $0.

- Price = probability: Prices are in USDC and act like probabilities (e.g., $0.35 ≈ 35%).

- Order execution & liquidity: Prices form from supply/demand and liquidity providers; large or fast-moving markets have narrower spreads.

- On-chain settlement: Trades and settlements are recorded on blockchain (Polygon), improving transparency and traceability.

What Markets Can You Trade?

For U.S. Users (Regulated App)

As of the initial launch:

✅ LIVE NOW (U.S.)

- Sports moneyline markets only

- NFL

- NBA

- NCAA football

- More leagues expected soon

❗ NOT YET LIVE (but self-certified)

- Elections

- Crypto markets

- Macroeconomic releases

- Tech/science events

- Pop culture markets

These categories remain available on the global Polymarket site, but are still pending regulatory rollout in the U.S.

For Global Users (Rest of World)

Polymarket still offers one of the broadest event-market catalogs:

| Category | Examples |

|---|---|

| Politics | U.S. elections, primaries, legislation |

| Crypto & Finance | BTC/ETH prices, ETF approvals, CPI, inflation reports |

| Sports | Major matches, tournaments |

| Culture | Awards shows, celebrity outcomes |

| Tech & Science | Product launches, rocket missions |

| Climate | Weather events, climate milestones |

How to Get Started on Polymarket

🛂 U.S. Access Model

Polymarket’s U.S. launch uses a KYC + waitlist system. Here’s how it works:

- Download the app

- Join the waitlist

- Complete identity verification (KYC) when prompted

- Wait for Polymarket to activate your account

- Once activated, you can trade sports moneyline markets (the first U.S.-approved category)

Two sign-up options (After Complete U.S Onboarding)

- Email/Google – simple one-click account creation.

- Crypto Wallet – MetaMask, Coinbase Wallet, or any WalletConnect wallet.

Step-by-step on signing up via Crypto Wallet

- Create or Open a Crypto Wallet

Set up a wallet that supports USDC and Polygon (MetaMask, Coinbase Wallet, or another WalletConnect-compatible app). This wallet will hold your funds and sign trades.

- Acquire USDC

Buy USDC on an exchange (Coinbase, Kraken, etc.) or via an on-ramp provider. USDC is the platform’s native unit for trading.

- Move Funds to Polygon (Bridge if needed)

If your USDC is on Ethereum mainnet, bridge it to Polygon (Polymarket may auto-bridge some flows). Using Polygon keeps transaction costs low.

- Connect Wallet to Polymarket

Visit Polymarket.com and connect your wallet via the wallet connect button. Confirm the connection through your wallet app.

- Complete KYC (when required for U.S. relaunch)

When U.S. trading is active, U.S. users should expect identity verification (KYC/AML) for compliance. Follow the on-screen steps to upload ID and verify identity.

- Place Your First Trade

Pick a market, choose YES or NO, set order size and type (market/limit), and confirm the transaction in your wallet.

- Monitor & Settle

Track markets in your dashboard. Once a market resolves, winning positions pay out $1 USDC per winning share.

- Withdraw Funds

Send USDC back to your external wallet. If you want to convert to fiat, withdraw from your wallet via an exchange that supports USDC/fiat conversions.

Does Polymarket Have a Deposit Bonus?

At the moment, Polymarket does not offer a live deposit bonus. However, filings with the CFTC in September 2025 show that a Deposit Incentive Program and a Refer-A-Friend Program are in the works for Polymarket’s U.S. relaunch, and other promos similar to those found among the best online betting bonuses in the U.S.!

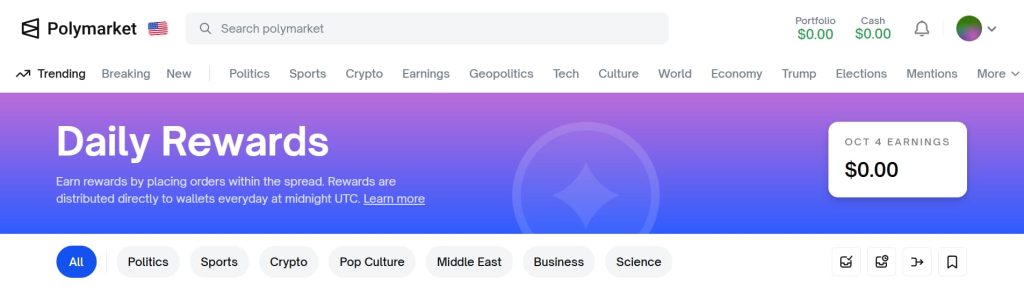

What’s Already Live

- Liquidity Rewards – Already live: users earn daily rewards for placing limit orders and providing liquidity to markets.

- 4% Annual Rewards – Already live: Polymarket now offers a 4% annualized return on select long-term markets, rewarding users who keep their positions open over time.

Polymarket Deposits & Withdrawals Options

Polymarket Deposits

| Option | Limits | Processing Time |

|---|---|---|

| USDC on Polygon | No formal minimum; cheapest | typically instant |

| MoonPay (Cards/Bank) | Regional limits; higher fees | Few minutes |

| Exchange Transfer | Exchange limits apply | 5–20 minutes |

| Bridge from other chains | Suitable for large deposits | 10–30 minutes |

| Large Deposits (> $50K) | Use DeBridge/Across/Portal | ~1 hour |

Polymarket Withdrawals

| Option | Limits/ Notes | Processing Time |

|---|---|---|

| USDC (Polygon) | Free, instant to wallet | Seconds |

| USDC.e (bridged) | Needed if exchange doesn’t support Polygon USDC | 5–15 min |

| Large withdrawals >$50K | May require splitting if pool liquidity is thin | Up to 1 hour |

| Bridge back to Ethereum/other chains | Gas + bridge fees apply | 10–30 min |

Making Your First Trade

- Deposit USDC into your account.

- Browse markets and filter by category (politics, sports, crypto, etc.).

- Select YES/NO and enter the amount.

- Confirm via your wallet.

- Monitor your portfolio; sell or hold until resolution.

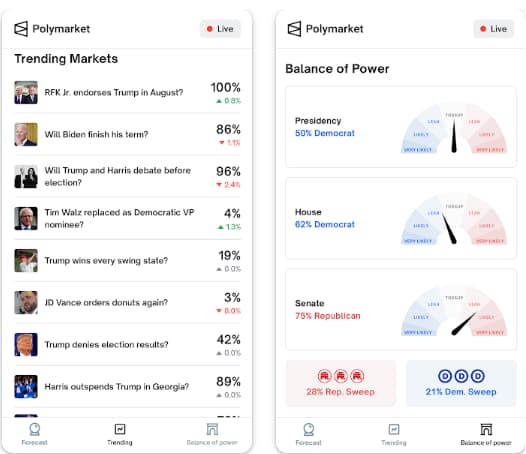

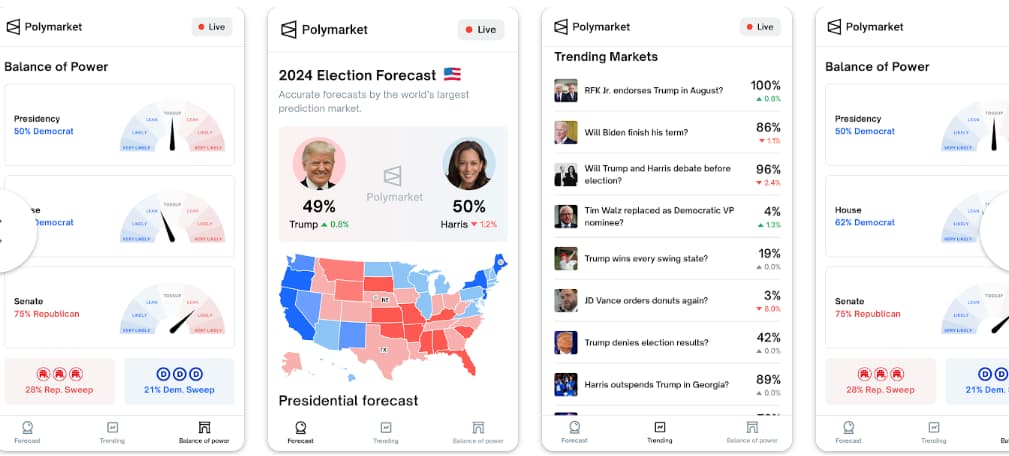

Does Polymarket Have a Mobile App?

Yes — and the U.S. relaunch is centered around the new Polymarket mobile app.

📱 iOS App — LIVE in the U.S.

- The iOS app is fully live on the App Store.

- Users can download the app and join the U.S. waitlist directly in-app.

- As of early December 2025, Polymarket has begun activating users from the waitlist and granting them trading access.

🤖 Android App — Coming Soon

- The Android version has been announced, but is not yet live.

- Polymarket says it will launch shortly after the iOS rollout stabilizes.

🌐 Web Version

- The classic web interface remains fully functional for global users.

- U.S. users will see a limited interface until their account is activated via the app.

Bottom line: The apps exist now, but the browser version is still the main hub for full functionality, especially for U.S. traders during the regulated relaunch. If you’re comparing mobile usability, check out our guide to the best mobile sports betting apps!

Fees Explained: what you will actually pay

| Fee Type | What You Pay |

|---|---|

| Trading Fee | No built-in “house vig”; costs come from spreads & liquidity |

| Gas Fees | Low on Polygon; higher if bridging from Ethereum |

| Relayer Fees | Small fee on some deposits/withdrawals |

| On-Ramp Fees | MoonPay charges card/bank fees |

💡 Pro Tip: Stick to Polygon USDC deposits to avoid costly bridge/on-ramp fees.

Liquidity & Market Depth

- High liquidity: U.S. elections, bitcoin price thresholds, macroeconomic releases

- Medium liquidity: Major sports & global political events

- Low liquidity: Niche culture/science markets

Spreads narrow on highly traded markets, widen on small-cap ones. Polymarket often incentivizes depth with liquidity reward programs.

Polymarket User Support & Resources

Polymarket provides multiple avenues to get help and learn the platform. For American users, here are some support options:

- On-site Help Widget (Live Chat)

- A live chat/help widget is often available on the site for quick questions and troubleshooting while logged in.

- Email Support

- You can reach Polymarket’s support team at [email protected]. The support link is also available at the bottom right corner of the homepage footer — simply click it and send your queries.

- Help Center & Documentation

- Extensive documentation covers deposits, withdrawals, market rules, dispute processes, and security best practices.

- Community Channels (Discord / Social)

- Polymarket maintains community channels (Discord and social profiles) where announcements, market discussions, and support threads live. These are useful for real-time news and community troubleshooting.

- Developer & API Docs

- For power users and developers, Polymarket offers API documentation and technical guides for pulling market data or integrating programmatically.

Security & Scam Prevention Tips For U.S. Players

- Always verify you’re on the official site (check the domain).

- Never share private keys or seed phrases.

- Use hardware wallets for larger balances.

- Double-check network and token addresses before sending funds.

- When in doubt, contact the on-site help or consult the Help Center.

Polymarket Pros & Cons

| Pros ✅ | Cons ❌ |

|---|---|

| Huge selection of markets (politics, crypto, sports, culture). | Crypto onboarding is complex for beginners. |

| Transparent settlement on the Polygon blockchain. | U.S. access is phased, not universal. |

| Low built-in trading fees (no sportsbook-style vig). | Card/bridge/on-ramp fees can add up. |

| Regulated U.S. return underway. | Liquidity is uneven in smaller markets. |

| iOS app live and onboarding U.S. users | Android app not yet live |

Polymarket vs Competitors

| Platform | Regulation | Pros | Cons |

|---|---|---|---|

| Polymarket | USDC, QCEX-based U.S. regulation | Largest global market selection; transparent; crypto-native | Phased U.S. rollout; sports-only at launch |

| Kalshi | Fully CFTC-regulated | Smooth fiat onboarding; broad event categories | Highly regulated; fewer markets than Polymarket globally |

| DraftKings (Prediction Markets) | U.S. sportsbook framework | Huge user base; instant onboarding | Very early product, limited depth |

| FanDuel (Prediction Markets) | U.S. sportsbook framework | Strong brand; easy onboarding | Limited categories; still launching |

| PredictIt | Academic exemption | Politics-focused | Low limits; restricted structure |

| Augur | Fully decentralized | No intermediaries | Poor liquidity; complex UX |

The U.S. prediction market space is intensifying — Polymarket’s timing is crucial.

Is Polymarket Safe & Trustworthy?

- Backed by VC investors (including Polychain, Dragonfly).

- Transparent settlement: trades clear on-chain in USDC.

- Regulatory compliance: In 2025, Polymarket restructured under QCEX to comply with U.S. regulations, subject to CFTC oversight.

Yes – Polymarket is now one of the most credible and transparent event-market platforms, especially following its structured U.S. compliance overhaul.

My Personal Experience Waiting on Polymarket’s U.S. Relaunch

As an American, I watched global users trade everything from elections to inflation data while I sat on the sidelines. The excitement comes from watching markets react instantly to news — polls, CPI releases, crypto volatility — and seeing probabilities update in real time.

The December 2025 U.S. rollout finally changes that. With KYC onboarding and sports markets now live for early users, I’m ready to trade rather than just observe. And I’m looking forward to when election and crypto markets eventually hit the U.S. app.

Final Verdict – Should Americans Use Polymarket in 2025?

If you’re crypto-comfortable and want real-time market odds on sports, elections, crypto, and cultural events, Polymarket is unmatched.

The 2025 QCEX acquisition and CFTC no-action letter mark a turning point – Polymarket is finally becoming a legit U.S. option.

- Best for: Crypto-savvy traders, political junkies, sports speculators.

- Not ideal for: Beginners who prefer fiat-first platforms (try Kalshi).

👉 Bottom line: For crypto‑savvy users who understand on‑chain risk and regulatory nuance, Polymarket is one of the most promising prediction‑market options as of 2025. The QCEX acquisition and limited CFTC relief materially improve its prospects for a compliant U.S. relaunch, but the rollout carries regulatory and operational uncertainty.

Polymarket FAQs: Frequently Asked Questions

Yes. It is launching under QCEX and CFTC approvals, with phased onboarding.

Yes, official iOS live now and Android apps coming soon, with full functionality expanding as compliance approvals finalize.

Yes. All U.S. accounts require full identity verification.

All trading is in USDC (Polygon).

Not yet. U.S. accounts currently have access to sports moneyline markets only.

No traditional deposit bonus, but liquidity rewards and yield programs are live. Additional promos are expected at full U.S. launch.

There’s no set minimum – trades can start with under $1 USDC.