The Billionaire Tax Trick That Keeps Sports Valuations Skyrocketing

Why are sports teams worth so much, even when leagues lose money? The WNBA lost $40 million last season, yet franchise values jumped 180%. The Golden State Valkyries were valued at $500 million in their first season, while new owners in Cleveland, Detroit, and Philadelphia each paid expansion fees of $250 million or more. Meanwhile, NFL teams average $6.5 billion in value (CNBC).

The growth story isn’t just ticket sales and TV deals. It’s tax law. Billionaires use a loophole that turns franchises into America’s most powerful tax shelters.

How Billionaires Use Sports Teams to Save on Taxes

U.S. tax law lets owners treat almost the entire purchase price of a team as if it were a “depreciating asset.” Under Section 197 of the tax code, intangibles like player contracts, media rights, goodwill, and even franchise rights can be written off over 15 years.

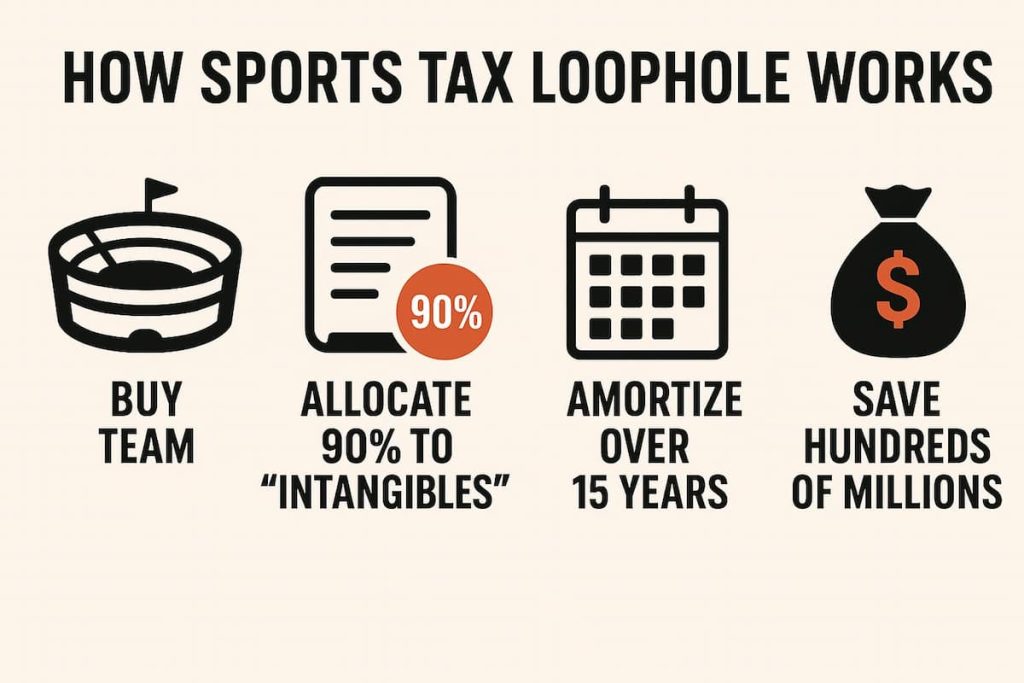

The process looks like this:

- Buy a team for billions.

- Allocate ~90% or more of the price to intangible assets.

- Amortize those assets over 15 years.

- Deduct annual losses against personal income.

- Save hundreds of millions in taxes.

👉 Example: A $2B purchase allocates $1.8B to intangibles → $120M annual deductions. Even if the team makes $20M in profit, on paper, it shows a $100M loss.

The Steve Ballmer Example

ProPublica’s 2021 investigation revealed how this plays out in real life.

When Steve Ballmer bought the LA Clippers for $2B, amortization slashed his tax rate to just 12%.

- Ballmer income: $656M

- Taxes paid: $78M

- Effective tax rate: 12%

For comparison: LeBron James paid 36%, and even a Clippers concession worker paid 14.1%.

A Loophole Decades in the Making

- 1940s: IRS lets MLB depreciate player contracts.

- 1970s: NBA franchises claim nearly all value as “contracts.”

- 1993: IRS excludes sports teams.

- 2004: MLB lobbying convinces President George W. Bush — a former Rangers owner — to reopen the loophole, expanding it across all leagues.

Sports intangibles, unlike machinery, don’t actually wear out. Players come and go, TV deals get renewed for more money, and franchise rights last indefinitely. Still, owners keep claiming these deductions.

Trump’s “One Big Beautiful Bill” Almost Killed It

This year, President Trump’s One Big Beautiful Bill included a clause that would have cut the amortization deduction in half for future buyers, raising an estimated $1B in federal revenue over 10 years (NY Post).

But NFL owners — including Robert Kraft, Jimmy Haslam, and Rob Walton — lobbied hard. Despite 71% of voters supporting the change, the Senate stripped the measure before final passage (ESPN).

What It Means for Fans

While billionaire owners win big, fans are often the hidden losers:

- Higher ticket prices → Teams increase prices to maintain revenue ratios

- Inflated streaming costs → Driven by soaring media rights deals

- Public subsidies → Cities fund stadiums & infrastructure, while owners cash in

- Player salary inflation → Sky-high valuations push salary caps upward, cycling costs back into fans’ pockets

Ultimately, taxpayers help fund billionaire wealth — often without realizing it.

Final Takeaway

Sports franchises are more than just trophies. Billionaires buy them for the prestige, but also for the tax advantages built into the system.

Trump’s attempt at reform showed how easily the system could change. Still, with team owners holding so much political influence, this tax benefit is likely to stick around. What’s next? Our sports news USA is frequently updated with the latest turnouts in American sports!