ESPN Bet’s Collapse: How PENN’s $1.5B Gamble Went Terribly Wrong

PENN Entertainment’s $1.5 billion gamble on ESPN Bet has ended in a costly collapse. The failed sportsbook venture reveals the harsh realities of the online betting market — and serves as a warning for investors chasing brand-driven growth.

Key Takeaways of PENN’s Costly ESPN Bet Collapse

- PENN Entertainment is ending its 10-year, $2 billion deal with ESPN after just two years.

- The company has lost $1.5 billion+ across its failed online-betting ventures — Barstool and ESPN Bet.

- Despite ESPN’s brand power, ESPN Bet captured only 3 % of the U.S. market share, ranking 7th nationwide.

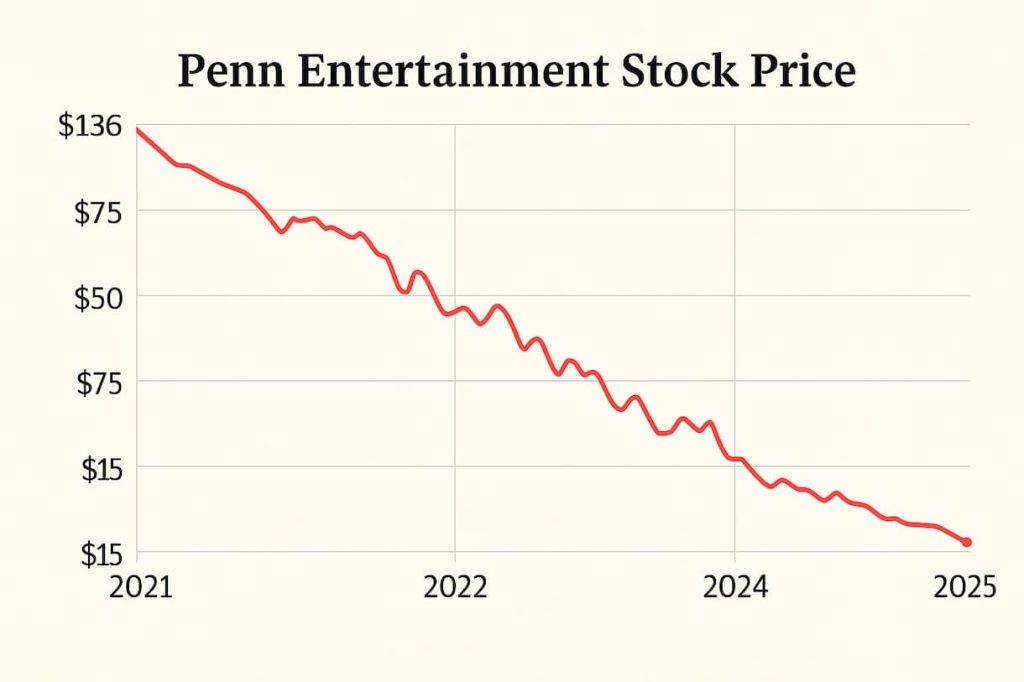

- PENN stock is down ~90 % since 2021; CEO Jay Snowden earned $120 million during that period.

- The collapse underscores that timing, distribution, and tech matter more than branding in sports betting.

A Costly Dream Collapses

Just two years after signing a $2 billion licensing deal with ESPN, PENN Entertainment is pulling the plug on its ESPN Bet app — a bold wager that has become one of the most expensive misfires in modern gaming history.

The partnership, announced with fanfare in 2023, promised to fuse ESPN’s unmatched sports media reach with PENN’s betting infrastructure. Instead, it exposed the unforgiving economics of the U.S. sports-betting gold rush — and left shareholders nursing over $1.5 billion in losses.

From Barstool to Bristol: Two Failed Bets

PENN’s online betting saga began long before ESPN Bet.

In 2020, the casino operator paid $550 million to acquire Barstool Sports, banking on founder Dave Portnoy’s cult following to slash customer acquisition costs. But after regulators balked at Barstool’s edgy content — and market share stagnated — PENN sold Barstool back to Portnoy in 2023 for just $1.

That same year, CEO Jay Snowden pivoted to ESPN, calling the new partnership “a once-in-a-generation opportunity.” PENN would pay $150 million annually in licensing fees and grant $500 million in equity warrants to Disney’s ESPN. The deal, valued at roughly $2 billion over a decade, was meant to buy legitimacy, scale, and trust.

It bought none of those things.

A Fast Start, Then a Freefall

When ESPN Bet launched in November 2023, the numbers looked sensational.

- 1.1 million downloads in its first week — a U.S. record.

- #1 in Apple’s App Store for 100 hours straight.

- Coverage in nearly every sports and financial outlet.

But the numbers were inflated by one-off promotions and forced migrations. Every existing Barstool Sportsbook user was required to download the new ESPN Bet app, while newcomers were lured by $250 sign-up bonuses.

By early 2024, engagement cratered. ESPN Bet’s market share stalled around 3 percent, trailing far behind FanDuel (46%) and DraftKings (35%). In major states like New York, Illinois, and New Jersey, it struggled to crack even 2 percent.

Bad Incentives, Brutal Economics

The ESPN deal suffered from poor incentive alignment. ESPN earned $150 million annually, whether or not the sportsbook succeeded, roughly twice its previous combined sponsorship revenue from DraftKings and Caesars. The network had little reason to push users toward a platform it didn’t own or operate.

Meanwhile, PENN’s losses mounted:

- $75 million in 2022

- $403 million in 2023

- $500 million in 2024

- $228 million through mid-2025

By the time PENN decided to exit, its online division had accumulated over $1.2 billion in losses — excluding licensing costs.

Snowden himself earned roughly $120 million in compensation over that period, while PENN’s stock plummeted nearly 90%, from $136 in 2021 to $15 in late 2025.

Why ESPN Bet Could Never Win

Even with America’s most recognized sports brand, PENN couldn’t outrun market gravity.

The reasons were structural:

- Late to market: FanDuel and DraftKings had already entrenched themselves post-PASPA repeal (2018). Their daily fantasy users became instant sportsbook customers.

- Unsustainable promos: Heavy bonuses boosted downloads but obliterated margins.

- Weak engagement mix: Only 30% of ESPN Bet wagers were parlays — versus 50–60% at rival books. Since parlays yield 3–4× higher margins, this was devastating.

- Limited synergy: Less than 0.1% of ESPN’s total digital audience ever downloaded the app.

In short: ESPN’s media reach didn’t translate into betting behavior.

Market Reacts: Relief, Not Panic

When PENN announced the termination on November 6, 2025, its stock rose 10% in pre-market trading — investors applauded the decision to stop the bleeding and refocus on the company’s profitable brick-and-mortar casinos.

PENN will now migrate ESPN Bet’s 2.9 million customers to a rebranded theScore Bet platform in December.

ESPN, meanwhile, has signed a new multi-year partnership with DraftKings, re-embracing the affiliate model it had pioneered years earlier.

A Case Study in Strategic Misfire

PENN’s dual failures — first with Barstool, then with ESPN — will likely be dissected in business schools for years. The company chased cultural relevance and scale through partnerships rather than building proprietary technology or organic distribution.

Analysts argue that timing, not branding, is the real moat in this industry. FanDuel and DraftKings dominated simply because they were ready the day PASPA was repealed. Everyone else has been fighting for scraps ever since.

Conclusion: The $1.5 Billion Lesson

PENN Entertainment’s experiment in digital betting will be remembered as a masterclass in overpaying for attention and underestimating economics.

The company tried to buy its way into sports culture — first through Barstool’s fanbase, then through ESPN’s empire — but ended up proving that distribution, timing, and product depth beat branding every time.

For ESPN and Disney, the pivot back to a hands-off model may prove wise. For PENN investors, the lesson is sharper: you can’t gamble your way into scale. Stay in the game with up-to-the-minute U.S. sports news, highlights, and expert analysis—right at your fingertips!

Frequently Asked Questions (FAQs)

The agreement was valued at approximately $2 billion over 10 years, including $1.5 billion in cash payments and $500 million in equity warrants to Disney’s ESPN.

Despite ESPN’s reach, the app struggled with user retention, low parlay volumes, and stiff competition from FanDuel and DraftKings. Its market share stagnated at around 3 %.

Combined losses from Barstool and ESPN Bet exceed $1.5 billion, excluding marketing and licensing costs.

PENN plans to migrate roughly 2.9 million users to its re-branded theScore Bet platform by December 2025.

ESPN will focus on content and affiliate partnerships, returning to a model similar to its earlier deals with DraftKings and Caesars.

Market entry timing, user retention, and product innovation matter more than big-name branding or expensive licensing.